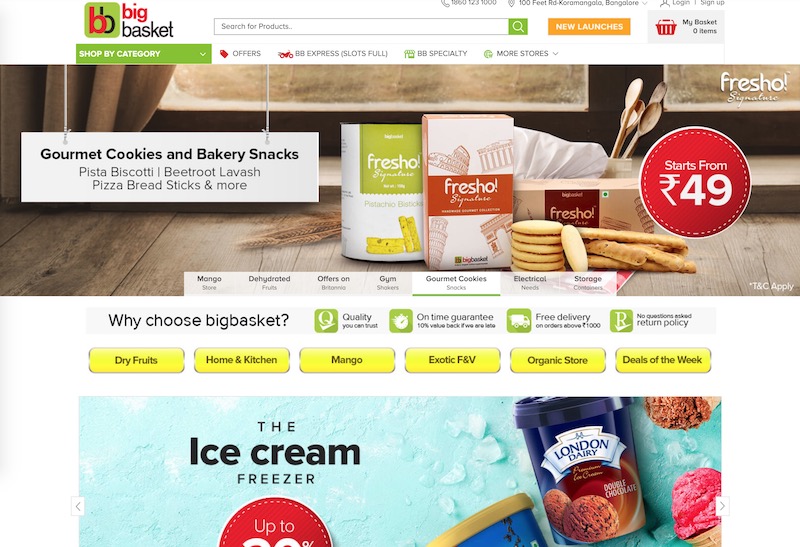

Photo: BigBasket

BigBasket, an India-based online grocery company, announced it has raised $150 million in Series F funding led by Mirae Asset-Naver Asia Growth Fund, CDC Group, and Alibaba. With this funding round, BigBasket has surpassed a $1 billion valuation giving it “unicorn” status according to co-founder Vipul Parekh via TechCrunch.

Alibaba is the largest investor in BigBasket as the company led the Series E round last year. And now Alibaba has about a 30% stake in the company.

Last year, BigBasket raised $300 million. And it has been keeping the company competitive against Walmart’s Flipkart and Amazon — which are both expanding their grocery operations in India.

BigBasket will be using the funding to expand its supply chain and set up more cold storage centers and distribution centers to deliver orders much faster. And BigBasket is planning to set up 3,000 vending machines with food and drinks in residential areas and office complexes net month. And currently, BigBasket is offering more than 20,000 products from 1,000 brands in more than two dozen cities.

Flipkart is reportedly setting up a fresh foods business soon. And it was reported that Flipkart may be acquiring grocery chain company Namdhari’s Fresh. However, Parekh told TechCrunch that it is a large market and unlikely going to be dominated by one single company. And BigBasket has one of the largest catalogs and the fastest delivery services compared to the competition, according to Parekh.

“The success in this business requires having the ability to build and manage a very complex supply chain across multiple categories such as vegetables, meat, and beauty products among others. Our focus has been on building the supply chain, and also ensuring that we are able to deliver a very large assortment of products to consumers,” Parekh added via TechCrunch.

BigBasket has been growing its subscription service to include milk and other daily eatables. And the company is expecting to become operationally profitable in the next six to eight months.

Some of BigBasket’s other rivals include local delivery company Grofers (backed by SoftBank) along with Swiggy and Dunzo (backed by Google).

“We have a unique opportunity to build one of the largest grocery businesses in the country in the country and we expect the capital raised in this round to continue to enable us to do just that,” added BigBasket co-founder VS Sudhakar via Livemint.

This is Mirae Asset Financial Group’s biggest investment in an India-based online company. Mirae Asset Financial Group generally invests in life insurance and securities but has become one of the largest investors in emerging market equities.

“Big Basket offers a transformational and convenient experience to its consumers, which makes it a preferred grocery platform,” explained Mirae Asset Global Investments’ head of India investments Ashish Dave. “As India moves towards organised retail that offers standardised quality, comfort and speed in the shopping experience, we firmly believe the Big Basket brand will continue to define this segment as a category leader.”