AdvicePay, a Bozeman, Montana-based fee-payment-processing platform designed for financial advisors has raised $2 million in seed extension funding. Rather than raising the funding from venture capital firms, AdvicePay crowdfunded the seed round through an advisor community.

The proceeds from this funding will be used for powering AdvicePay’s growth such as launching an Enterprise version to meet demand from the hybrid independent broker-dealer and large RIA marketplaces.

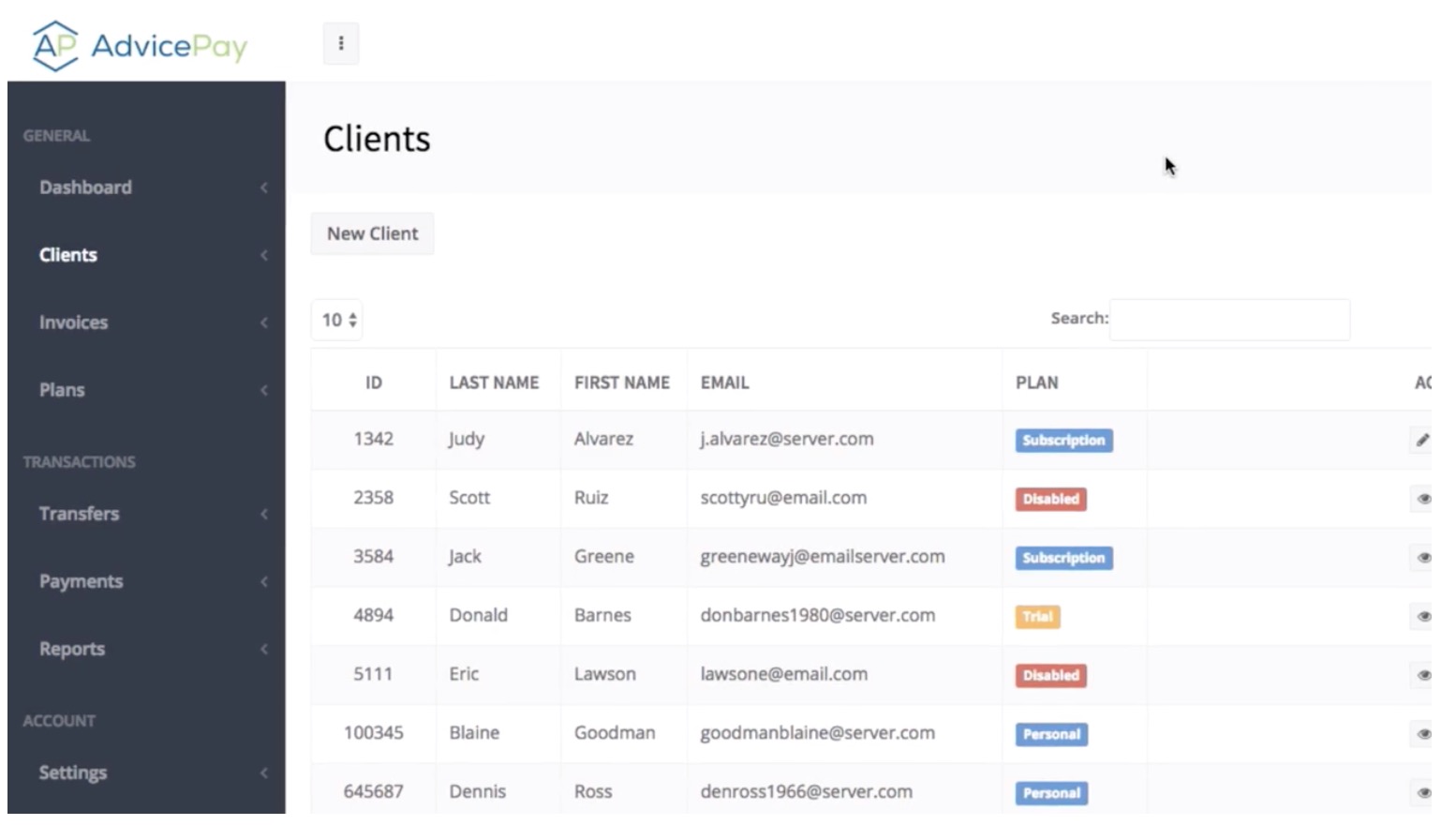

Photo: AdvicePay

Photo: AdvicePay

“We chose the innovative approach of crowdfunding with advisors versus going the traditional venture capital route to ensure that we would be able to stay focused on serving the needs of our core target market of financial advisors,” said AdvicePay co-founder Michael Kitces in a statement. “As a solution built by financial advisors, for financial advisors, we knew the advisor community would immediately understand the need and problem that AdvicePay was built to solve. This approach was more than validated by the high advisor demand we saw from just one article on the Nerd’s Eye View blog, allowing us to get full commitments for the entire funding need in less than 2 months.”

AdvicePay Enterprise was built in the past four months from AdvicePay’s seed extension funding. The AdvicePay Enterprise platform includes expanded features like tools built specifically for organizations that support large numbers of advisors and must manage key oversight and compliance protocols.

This includes a dedicated home office portal that enables firms to centrally manage and control billing and payment processing. And it allows for local flexibility at the advisor level.

Plus AdvicePay Enterprise meets the specialized compliance and security requirements of larger financial services organizations and provide dedicated relationship managers to facilitate on-boarding of new advisors, training, and ongoing support.

Advisors can incorporate AdvicePay’s payment processing system to expand their business models to charge minimum advice fees, ongoing monthly/quarterly/annual retainer fees. And then clients can be billed directly through the platform in order to avoid invoices, paper checks, and manual processes.

“As the fee-for-service movement in financial planning gains momentum, more and more advisors are working with clients by directly charging for their advice outside of or alongside an asset management fee for portfolio management,” added AdvicePay co-founder and CEO Alan Moore. “However, current billing systems from third-party providers are not built to avoid triggering SEC custody, and present a number of compliance oversight issues for larger financial institutions that service hundreds or thousands of advisors.”