Alto, a Nashville, Tennessee-based technology platform that makes it easier for investors to add alternative assets to IRAs, recently announced it raised $2.8 million in a seed round of funding to expand its offerings and integrate additional investment platform partners. Including this round, Alto raised $3.8 million. The investors in this round include Jake Gibson (NerdWallet founder), Foundation Capital, Sequoia’s Scout Fund, Amplify.LA, and First Check and Green D Funds.

The Investment Company Institute (ICI) reported that Americans have more than $28 trillion of assets in retirement accounts including $9 trillion in IRAs. However, only about 1% of IRA assets are invested in alternatives with an IRA.

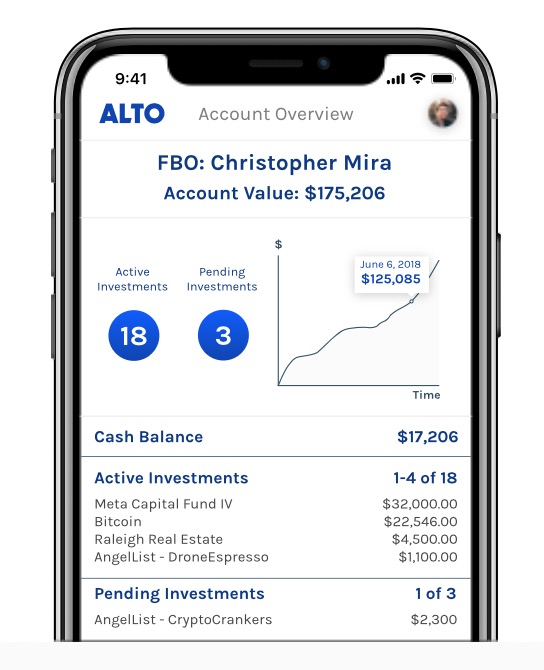

Photo: Alto

Alto’s Alternative IRA service is an individual retirement account that gives investors the freedom to invest in alternative assets such as startups, private companies, real estate, loans, and digital currencies. These diversified investments are powered by Alto’s investment platform partners such as AngelList.

“The vast majority of investors have no idea they can use their retirement savings to invest in alternative assets, like startups and real estate, while maintaining the tax advantage of IRAs,” said Alto CEO Eric Satz. “And even when they do know they can invest in alternatives, they choose not to due to the confusing process and arduous amounts of paperwork.”

Alto said there are several reasons why more investors should consider alternatives in their IRAs:

1.) The rise of index-based investing makes it difficult to achieve above-market returns.

2.) Market analysis has been demonstrating the value of adding sources of non-correlated returns to portfolios.

3.) Many fast-growth companies which would typically move to the public markets are staying private for a longer amount of time due to surpluses of private capital.

4.) The potential for significant returns in alternatives are further enhanced due to the tax advantages of IRAs, particularly ROTH IRAs in which returns are not taxed.

5.) IRAs are long-term investment accounts and this fits the liquidity characteristics of most alternatives like startups, real estate, and lending.

Before launching Alto, Satz founded Currenex — which is an online global foreign currency exchange company that serves banks, hedge funds, active traders, etc. State Street Corp. acquired Currenex for $564 million in 2007.