Imperative Execution, a Stamford, Connecticut-based financial technology company that developed a new trading venue for institutional investors called IntelligentCross, has raised a $9 million Series A round of funding.

This round of funding included participation from major buy-side firms, venture capital firms, and industry executives. IntelligentCross uses artificial intelligence assisted scheduled matching, which was engineered to reduce market impact.

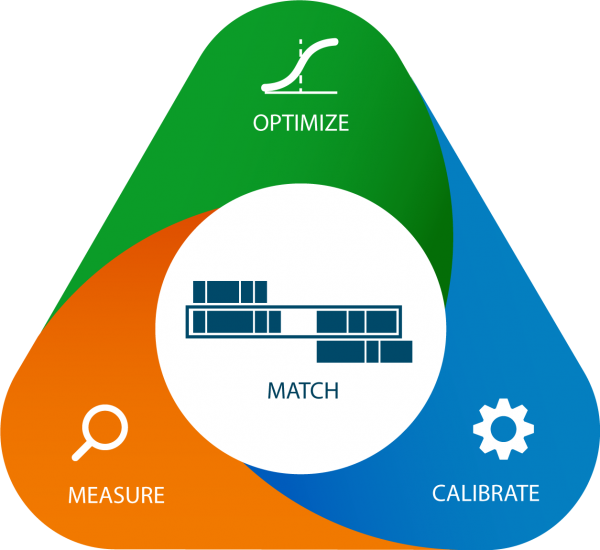

Using machine learning and artificial intelligence, IntelligentCross optimizes order matching to help investment managers reduce costs while maximizing liquidity.

Photo Credit: Imperative Execution

“We founded Imperative to create more efficient markets. Market efficiency for institutions is about market impact – a measure of price dislocation during trade execution. It affects everyone with an investment account from Main Street to Wall Street. The brokerage community has done an impressive job of developing advanced execution algorithms to help with this, but trading venues – exchanges and alternative trading systems that match buyers and sellers – have lagged in innovation,” said Imperative Execution chief executive and founder Roman Ginis. “We believe our approach to market design, building smart venues that optimize for investor objectives, has the potential to truly transform trading in the same way that smartphones have transformed our communications. We are pleased to secure this next round of funding to pursue our mission to make the market more efficient.”

IntelligentCross was built to minimize market response after each trade and lower market response implies lower information leakage — which is crucial for institutional investors looking to avoid moving the market.

And IntelligentCross also matches orders at scheduled times, which are typically milliseconds apart. Each match is at the market midpoint (NBBO mid). Plus IntelligentCross has a single order type (mid peg) that fits into electronic execution workflow without requiring programming or changes to the broker’s algorithmic suite or the entry process on the buy side.

“The impact of institutional investors’ trades on the market has been one of the most significant issues since the days of the Buttonwood tree. The average US equities transaction size has dropped below 200 shares per trade, which has made this challenge even more pressing,” added Tabb Group chairman and founder Larry Tabb. “The application of AI to dynamically address this problem has the potential to be a game changer, and early results are truly encouraging.”