MAULOA is a firm of long-term investors that provides owner liquidity and working capital to family-owned businesses to accelerate growth. Pulse 2.0 interviewed MAULOA founding partner Andrew Sachs to gain a deeper understanding of the firm.

Andrew Sachs’ Background

Could you tell me more about your background? Sachs said:

“I was born in Los Angeles and grew up in San Diego, attending La Jolla Country Day School and playing Torrey Pines Golf Course for $5. My dream was to become a professional golfer, and I often battled with a young Charley Hoffman at Stone Ridge Country Club. However, destiny had other plans for me, and I was fortunate to be blessed with a talent for math and problem-solving.”

“I attended the Georgetown University Walsh School of Foreign Service and earned an MBA through a five-year program, along with a General Course degree from the The London School of Economics and Political Science (LSE). Initially, I envisioned a career as an economist or lawyer, but my path took an unexpected turn when I started my career in private equity at Morgan Stanley Capital Partners in New York. At the time, it was the second-largest buy-out fund in the world, led by Alan Goldberg and Frank Sica. My time there was brief because my first cousin, Kevin McCollum, a budding Broadway producer, won his first Tony with RENT. Together, we launched KMS Investments, marking the beginning of my entrepreneurial investment career.”

“The next chapter was Capital Investors II, an early-stage venture capital fund with LPs that included many of Greater Washington, DC’s leading entrepreneurs and financiers. Founded by Senator Mark Warner and Russ Ramsey, the fund also boasted names like Marc Andreessen, Ted Leonsis, Jeong Kim, and Michael Saylor among its backers.”

“Subsequently, I co-founded Bethany Partners, LLC, a private equity boutique, with Joshua Freeman of Carl M. Freeman Companies. We embraced a simple thesis: investing in local, growing companies with quality management teams. Less than five years into our journey, the world lost a remarkable spirit, and I lost a friend, mentor, and business partner when Joshua was tragically killed in a helicopter crash. This was the time when Sachs Capital (now named Mauloa) was founded.”

Evolution Of The Firm’s Thesis

How has your firm’s thesis evolved over time? Sachs noted:

“Prior to Sachs Capital, I ran three funds, investing in numerous companies using varying investment strategies. This journey ultimately led me to the idea of applying the venture capital investment structure to smaller, profitable private equity companies. I thought of it as “venture cash flow investing,” and I loved it because it aligned and incentivized all stakeholders, with our capital in a preferred position to protect the downside. This approach included minority governance protections, allowing owners to keep control of their destiny while generating annual cash flow to LPs.”

“Over the first 15 years, mostly through failures and YPO learnings, I refined my investment strategy, eventually realizing that regardless of one’s quantitative prowess, an investment’s success is mostly driven by the character of management. Not coincidentally, this realization coincided with changing our name from Sachs Capital to Mauloa, which means “endless” in Hawaiian.”

Favorite Memory

What has been your favorite memory working for your firm so far? Sachs reflected:

“My favorite memory, so far, is our first exit which was very successful. It solidified our investment thesis and was the first of several investments that propelled Fund I to success.”

Significant Milestones

What have been some of your firm’s most significant milestones? Sachs cited:

“We raised $26 million for our first fund and invested an additional $57 million alongside into seven businesses. Following the success of Fund I, we raised $65 million for our second fund and invested an additional $80 million alongside into 10 companies.”

Investment Success Stories

Would you like to share any specific investment success stories? Sachs highlighted:

“We provided $10 million liquidity to owners of a business services company, so they were comfortable taking on more working capital. Due to this additional flexibility, the Company generated over $70 million operating cash flow in the first seven years post transaction.”

Metrics

Can you discuss total AUM or any other notable metrics? Sachs revealed:

We seek to produce 10%+ annual cash distributions plus greater than 2x return on original investment through equity appreciation. Mauloa has deployed over $200M and partnered with more than 20 companies.

Differentiation From Other Firms

What differentiates from other firms? Sachs emphasized:

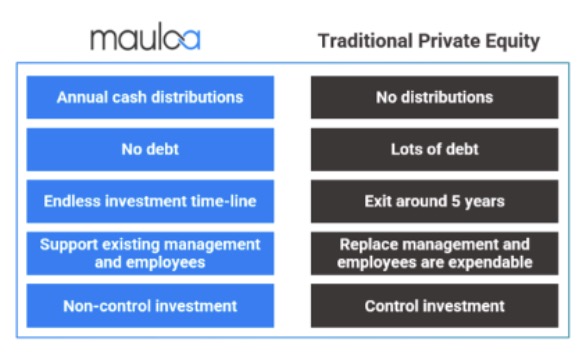

“We are long-term investors who provide owner liquidity and working capital to family-owned businesses to accelerate growth. We invest $10-30M for 30-40% of your middle-market company without using debt, ruining your culture, or ever forcing you to sell. Instead, we all receive regular cash distributions from profits, which keeps everyone’s interests ENDLESSLY aligned.”

Challenges Faced

What are some of the challenges you faced while working at the firm? Sachs acknowledged:

“The most difficult piece of investing and business in general is people. Our challenges have come when we invest in people who do not fit the Mauloa culture. We seek to invest in people we ‘like, trust and admire.’”

Future Goals

What are some of your firm’s future goals? Sachs concluded:

“We deeply believe small to middle-sized businesses are the backbone of America’s $30 trillion GDP. Providing patient capital for owner liquidity and working capital for growth to family businesses makes our country stronger. The current ecosystem for private equity is the complete opposite: short time frames, lots of debt, and a focus on investors rather than employees, with IRR as the main indicator of investment success. Mauloa supports “authentic” American capitalism and seeks to build endless streams of cash flow by investing in and supporting family businesses for the long run.”

Additional Thoughts

Any other topics you would like to discuss? Sachs concluded:

“The traditional PE playbook is broken. Specifically, the irresponsible use of excessive debt is destroying companies, employees lives and their communities….all the while enriching PE.”