Price f(x), a Munich, Germany-based cloud pricing software company, announced it has raised €25 million in Series B funding. This round of funding was led by Digital+ Partners and Bain & Company. Existing investors Credo Ventures and Talis Capital also participated in this round.

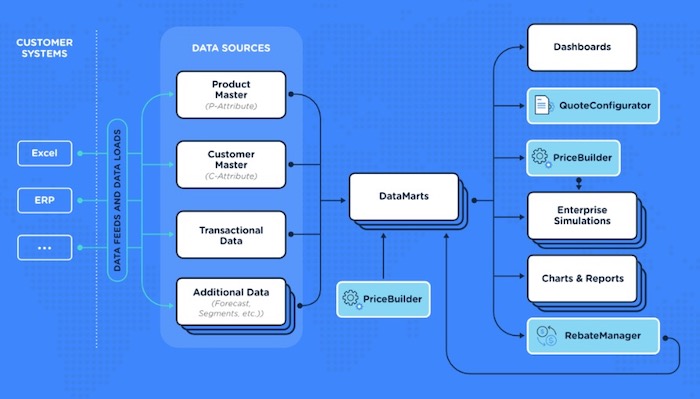

Founded in 2011, Price f(x) offers a modular SaaS solution for Price Optimization, Management (PO&M) and Configure-Price-Quote (CPQ) for enterprises of any size based on the native cloud architecture.

Photo Credit: Price f(x)

Photo Credit: Price f(x)

“Price f(x) has become the leading SaaS pricing solution provider on the market through its customer centric approach and by offering a feature-rich, highly flexible pricing tool that is also risk free and fast to implement,” said Price f(x) CEO and co-founder Marcin Cichon in a statement. “Our success is based on the continued satisfaction and loyalty of our customers. This new funding will allow us to help even more businesses to thrive by further expanding our existing platform capabilities and also introducing a new product offering for the SME market segment.”

Price f(x) currently serves over 80 global blue-chip B2B and B2C customers across a range of industries such as Robert Bosch, SchneiderElectric, Owens-Illinois, Iron Mountain, and Sonoco And Price f(x) also has a partner ecosystem with global technology and integration providers such as Bain & Company and SAP.

For example, Price f(x) and Bain & Company recently announced a partnership for developing the Bain Pricing Navigator. The Bain Pricing Navigator offers clients a software tool that enables customers to assess and adjust pricing based on the company’s performance by leveraging real-time dashboards, insights, templates, and CRM and ERP systems.

Digital+ Partners founding partner Axel Krieger said that his team is very impressed by what Marcin and the team achieved to date and sees a huge growth opportunity ahead. And he pointed out that Price f(x) also built a “world-class product” that is driven by “relentless customer focus.”

According to a Bain study of over 1,700 pricing decision-makers, 70% of companies believe that pricing is a top management priority. But more than half of respondents conclude that management has insufficient visibility into pricing decisions. And less than 20% of the companies surveyed have appropriate tools and dashboards for improving pricing decisions.

Bain & Company global pricing leader Ron Kermisch pointed out that pricing is the single most effective lever for boosting earnings for most companies. And Kermisch said that many companies “leave money on the table because they do not set the best price or ensure customers actually pay the price they have determined.”