Realfinity is an embedded finance platform designed for the real estate and mortgage industry. Realfinity is a loan origination and processing platform built for real estate agents to become dually licensed and offer mortgage services. By utilizing an embedded finance model, Realfinity not only simplifies operations for agents but also delivers significant cost savings to consumers, offering better rates, faster execution, and a more seamless homebuying experience. Pulse 2.0 interviewed Realfinity co-founder and CEO Luca Dahlhausen to gain a deeper understanding of the company.

Luca Dahlhausen’s Background

What is Luca Dahlhausen’s background? Dahlhausen said:

“I was born and raised in Germany and have always been passionate about finance and technology. I hold a degree in Management & Technology from the Technical University of Munich. Before founding Realfinity, I worked at a large retail lender, LendUS, where I gained deep insight into the mortgage industry. This experience allowed me to understand the complexities of capital markets, mortgage pricing, and the inefficiencies in the home financing process. My career has been driven by a desire to create financial solutions that empower both consumers and professionals, ultimately leading to the development of Realfinity.”

Formation Of The Company

How did the idea for the company come together? Dahlhausen shared:

“My introduction to the mortgage industry through my role at a major retail lender sparked my interest in capital markets and mortgages specifically. One of the biggest issues I encountered was the high cost of originating a loan in the U.S. This inefficiency created an opportunity to innovate and streamline the process. My fascination with embedded finance led me to develop a solution that integrates mortgage services into existing business models, reducing costs and increasing accessibility for professionals and consumers alike.”

Favorite Memory

What has been your favorite memory working for the company so far? Dahlhausen reflected:

“Every single closed loan is a favorite memory! Each time a professional or business adds mortgage services to their existing offerings through our infrastructure, it’s a testament to the impact we’re making in the industry. Watching businesses evolve and thrive by integrating our technology has been incredibly rewarding.”

Core Products

What are the company’s core products and features? Dahlhausen explained:

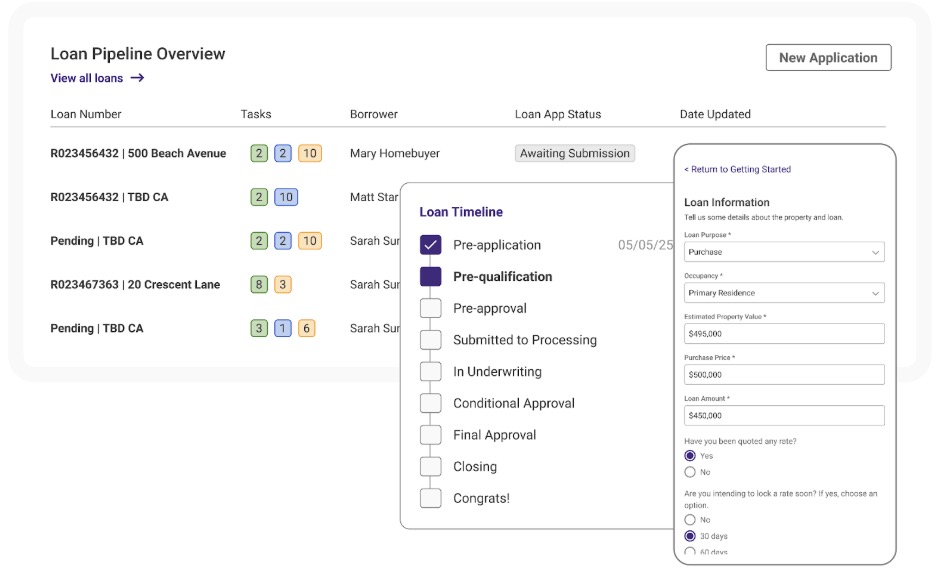

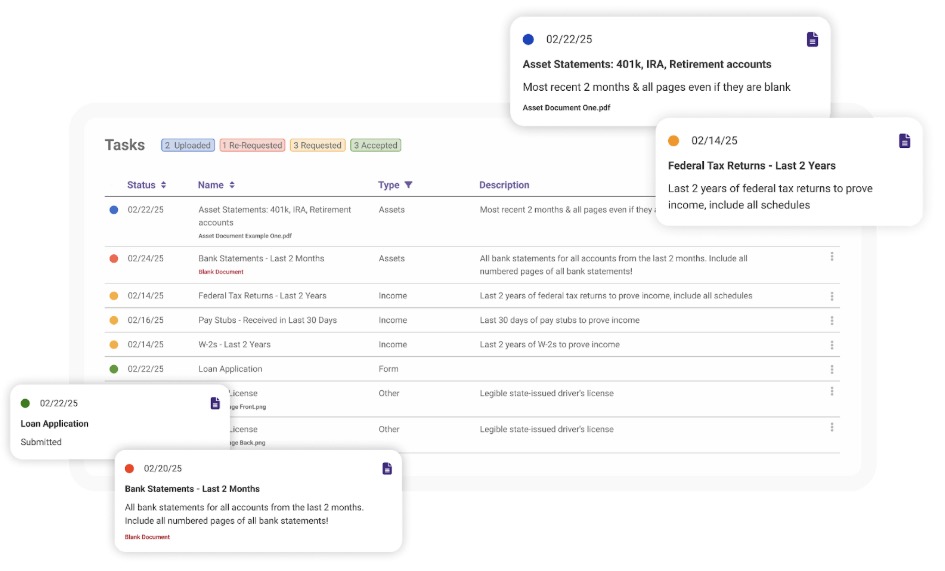

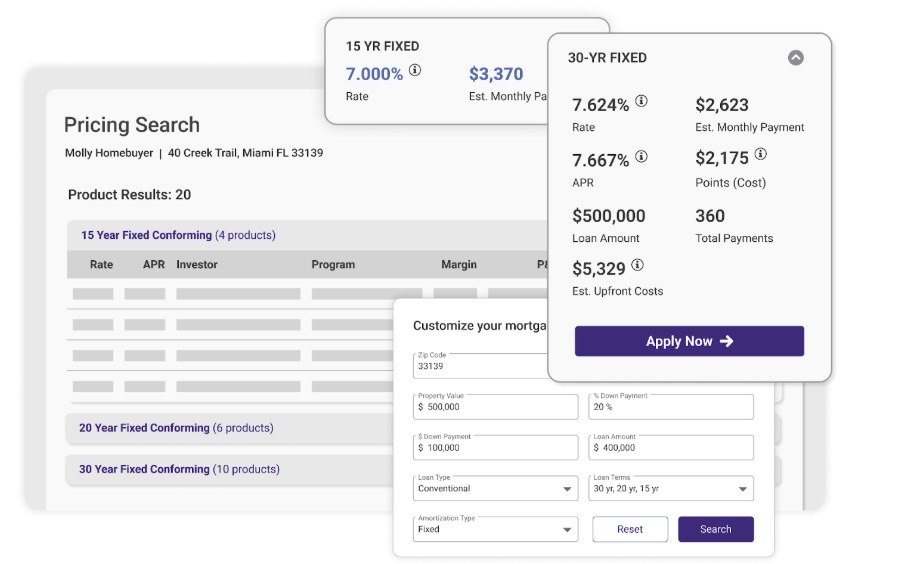

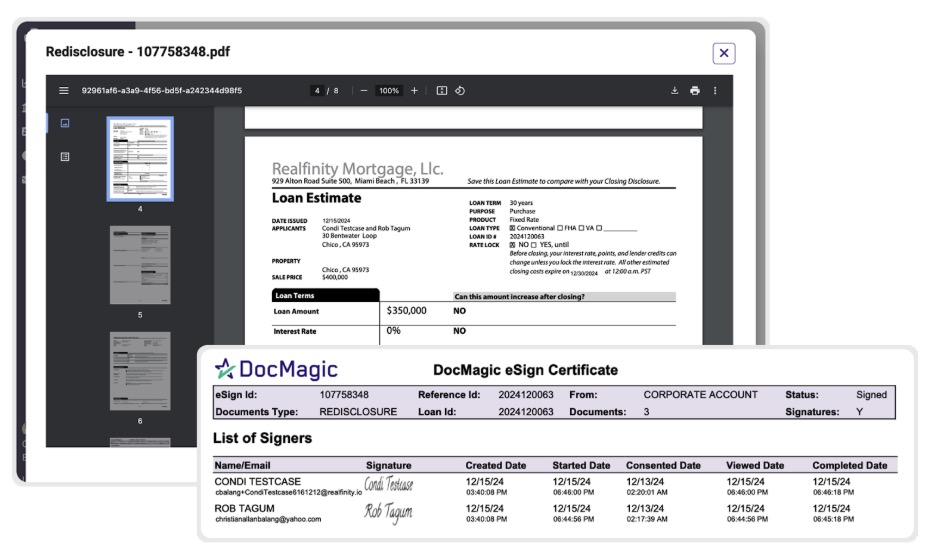

“Realfinity’s Origination Platform is an embedded lending solution that enables agents and companies to integrate mortgage services seamlessly. This can be done via our proprietary app or through APIs that allow businesses to embed mortgage solutions directly into their existing platforms.”

Challenges Faced

What challenges has Dahlhausen and the team faced in building the company? Dahlhausen acknowledged:

“The lending and residential real estate industries are highly fragmented and historically slow to adopt new technologies. We’ve overcome this by focusing on clear, tangible benefits for consumers, primarily better mortgage pricing. By providing a more efficient, cost-effective solution, we’re able to drive adoption and position ourselves as leaders in mortgage innovation.”

Evolution Of The Company’s Technology

How has the company’s technology evolved since its launch? Dahlhausen noted:

“We are constantly enhancing our platform to deliver a simpler and more effective lending experience. One of our latest advancements is the use of AI to analyze income, assets, and liabilities, enabling us to generate fully automated and instant loan pre-approvals. This innovation streamlines the mortgage process, making it more efficient and accessible for both professionals and consumers.”

Significant Milestones

What have been some of the company’s most significant milestones? Dahlhausen cited:

“Since our official launch in 2024, we have already originated more than $50 million in mortgage loans. This rapid growth highlights the demand for a more efficient and cost-effective lending solution in the market.”

Total Addressable Market

What total addressable market (TAM) size is the company pursuing? Dahlhausen assessed:

“Residential real estate is the largest asset class in the U.S. In 2025, the U.S. mortgage market is projected to originate more than $5 trillion in loans. This represents a massive opportunity for innovation and disruption.”

Differentiation From The Competition

What differentiates the company from its competition? Dahlhausen affirmed:

“Our key differentiators include a significantly lower cost to originate a loan and a fundamentally different distribution model. By embedding mortgage services into existing businesses rather than relying on traditional lending channels, we create a more streamlined and cost-efficient process.”

Future Company Goals

What are some of the company’s future goals? Dahlhausen concluded:

“Our goal is to become the leading embedded finance platform in the mortgage industry. We aim to continue expanding our technology, increasing adoption, and transforming the way mortgages are originated and serviced.”