STASH has made a number of big announcements this week including a new mobile-first banking service in partnership with Green Dot Corporation and its subsidiary Green Dot Bank along with a $65 million Series E round of funding. Plus STASH is also launching a new rewards program feature called Stock-Back — which is a rewards program that invests for customers as they spend. This round of funding will be used for increasing product growth and propelling brand awareness.

The Series E round was closed in February. Including this round, the company raised more than $150 million in funding from investors like Breyer Capital and Union Square Ventures. And STASH hit more than 3 million customers since it launched.

STASH generates revenue from a subscription model. The investment account costs $1 per month and the retirement accounts start at $2 per month for balances up to $5,000. And then STASH charges a percentage after that amount is surpassed.

Stock-Back users will automatically earn fractional shares of stock on qualified purchases by simply using their STASH debit card and it builds portfolios that reflect their spending habits by “investing directly in the companies that they shop, eat, watch, listen, and live with.” So if you buy a meal at a local restaurant, make a purchase at a local bookstore, or pay for a parking meter, then you will earn Stock-Back in a STASH-approved ETF.

And when customers buy a burrito at Chipotle, pay for T-Mobile bills, or shop at Amazon or Walmart, then they will earn a piece of each of those companies’ publicly traded stock. The Stock-Back rewards will be invested in customers’ STASH personal investment accounts.

“80% of Americans are living paycheck-to-paycheck… Stock-Back is our way of utilizing STASH’s smart, patent-pending technology to help people build better financial habits and invest in their future. Our ability to give customers the opportunity to save and build portfolios that mirror their spending behavior and preferences is incredibly powerful,” said STASH co-founder and president Ed Robinson in a statement. “During the testing period, we saw an overwhelmingly positive response from users as they pay ordinary bills like Netflix, and in return received Netflix stock as well as access to dividends, educational resources and financial advice. It’s a winning combination for our over 3 million customers.”

The base reward is 0.125% for the Stock-Back program. But STASH is going to quickly ramp up the rewards when layered with exclusive offers and partner deals, of which some will be up to 5% Stock-Back. At launch, the Stock-Back Rewards program will give customers a base reward of .125% for every qualifying purchase in the respective publicly-traded stock or an investment in a STASH-approved ETF.

“Beyond democratizing access to the stock market, we’re trying to upend an ecosystem where financial services companies continue to take from the masses, and pile on fee after fee. At STASH, we believe the customer should keep more of their money, which is why we built a unique rewards program that invests in them when they spend. Now, with Stock-Back Rewards, we can really deliver on the holistic experience we set out to achieve, helping our customers maximize their financial power,” explained STASH co-founder and CEO Brandon Krieg. “We’ve truly built a full-service financial platform for investors. STASH customers will become investors and own stock in companies and sectors they support—with each qualified swipe of their STASH debit cards.”

STASH’s banking services are powered by Green Dot’s Banking as a Service Platform — which includes a debit account with no overdraft or monthly maintenance fees, access to a large network of free ATMs nationwide, and ASAP Direct Deposit (enables customers to get paid up to two days early). And every STASH customer also receives personal guidance across every aspect of their finances ranging from spending to saving and investing.

“I have invested in and served on the Board of many leading companies, and it’s clear how a program like Stock-Back can power immense brand loyalty,” added Breyer Capital founder and CEO Jim Breyer. “The early data shows unequivocally that share ownership drives increased sales and customer appreciation. This innovative new technology from STASH will have CEOs and CMOs knocking on their door.”

“It’s been incredible watching this product come to life and to experience all the collaboration and ingenuity that went into its design,” commented Green Dot’s head of banking as a service Dov Marmor. “We’re proud to partner with STASH to provide an innovative banking solution for all Americans, demonstrating the versatility of Green Dot’s Banking as a Service platform, and enabling a simplified banking and investing experience for STASH’s millions of customers.”

STASH has curated a selection of more than 200 stocks and ETFs and the company’s clients can build personalized portfolios that reflect their investing interests and goals. The full suite of products includes personal investment accounts, Traditional and Roth IRA’s, and custodial investment accounts. And in partnership with Green Dot Bank, STASH offers banking services including checking accounts and debit cards.

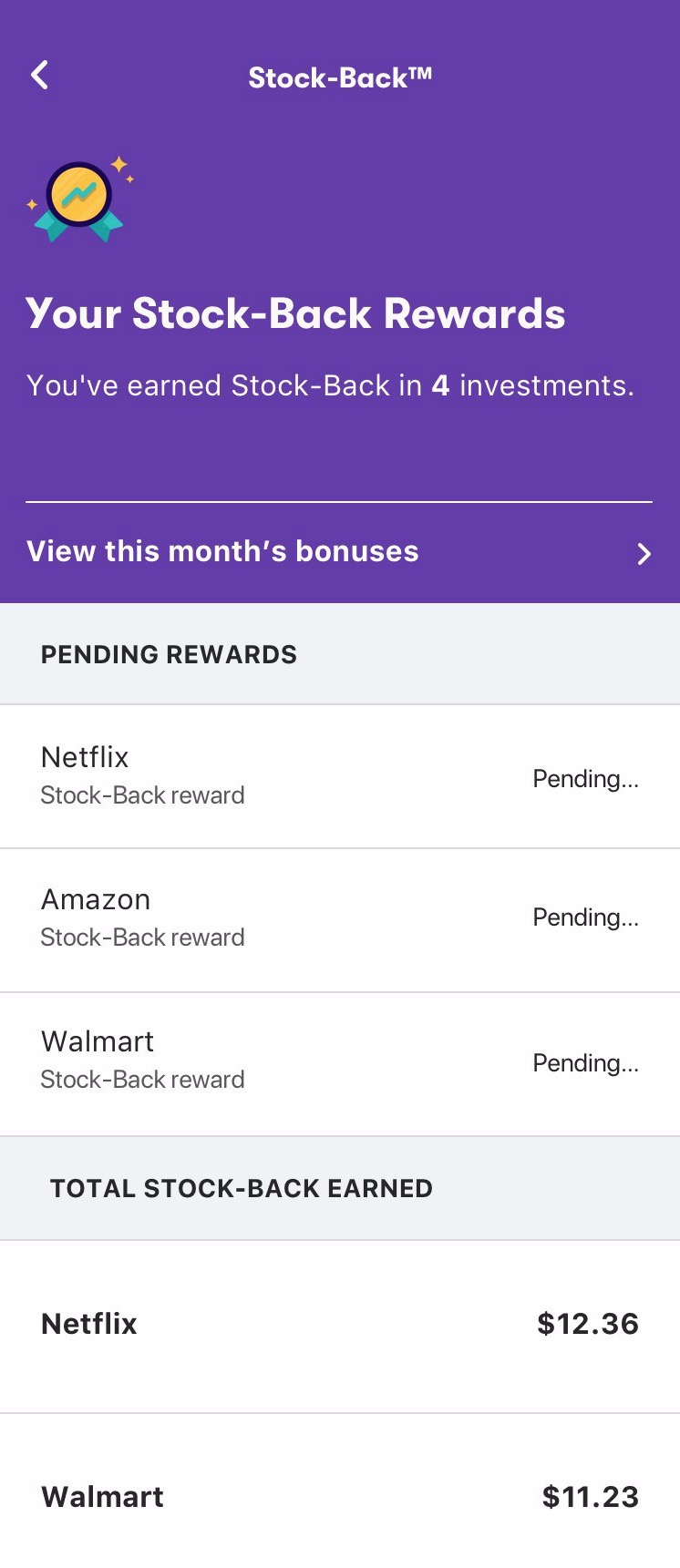

Here is how the user interface of the Stock-Back looks: