On Thursday, ride-hailing company Lyft announced its intentions for an initial public offering in a confidential filing with the U.S. Securities and Exchange Commission (SEC). While it was believed that Lyft was leaving Uber behind in the chase for an IPO, The Wall Street Journal reported yesterday that Uber also confidentially filed for an IPO on Thursday. Between these two ride-sharing giants, they are expected to be two of the biggest tech company debuts in the first half of 2019.

The filing of the IPOs is coming at a time when investors are fearing a potential recession and it has become a tough climate for public technology companies. Uber received proposals from Morgan Stanley and Goldman Sachs to take the company public. And Lyft selected JPMorgan Chase, Credit Suisse, and Jeffries to underwrite the IPO, Reuters reported.

Uber, the larger of the two ride-hailing companies, might be valued as high as $120 billion in an IPO. This would be the largest offering for a company since Alibaba Group of China started trading on the New York Stock Exchange in 2014. At this market capitalization, it would put Uber at about the same valuation as McDonald’s and about three times more than General Motors. Back in August, Uber received a $500 million investment round at a valuation of $76 billion so the estimated value associated with the IPO is a significant jump.

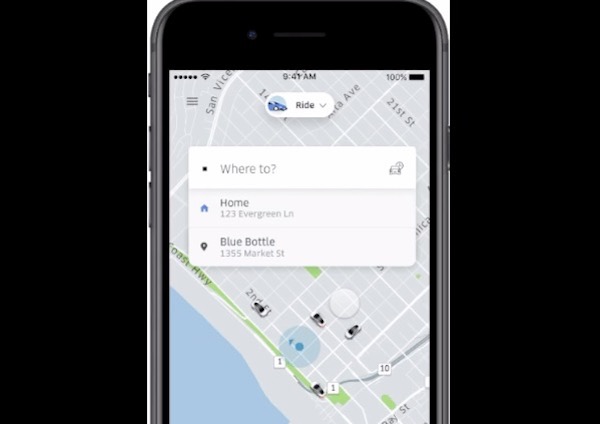

Photo: Uber app / Credit: Uber

Uber is far from profitable as the company lost $1.07 billion on revenue of $2.95 billion in the third quarter. Even though Uber does not have to disclose its earnings as it is a private company, the company did so anyway. Some of Uber’s biggest costs include the payments to drivers, the cost of the expansion, reinvestment in new technology such as autonomous vehicles, and operational costs of expansion.

Dara Khosrowshahi, the chief executive of Uber, has been finding ways to cut costs such as selling off its operations around Southeast Asia and Russia where local rivals have been aggressive. And Uber moved into new businesses such as food delivery and scooter rentals. Uber is profitable in cities where it has been established the longest.

When Garrett Camp was the CEO of StumbleUpon in early 2009, he initially founded Uber under the name UberCab and invested $250,000 into the company. Later this year, he was joined by Travis Kalanick. The idea for the company started out as a black car service where that type of service would be more affordable if it was shared by a group of people. By the following year, Uber had received over $1.2 million in angel funding and the company had a few cars on the road. Now Uber is available in more than 600 cities across 63 countries and more than 15 million trips are set up per day. Some of Uber’s other investors include Benchmark, First Round Capital, TPG, SoftBank, and Fidelity Investments.

According to Bloomberg’s calculations, former professional bicyclist Lance Armstrong is expected to make $20 million from a $100,000 early investment in Uber. Armstrong had invested in Uber through Lowercase Capital, the venture firm launched by Chris Sacca.

Uber faced a number of growing pains along the way. Earlier this year, one of Uber’s driverless vehicles killed a pedestrian in Arizona. And the company dealt with a number of harassment cases. Kalanick resigned from the company in June 2017 amidst the harassment cases along with an intellectual property lawsuit from Alphabet’s self-driving vehicle company Waymo, and a federal investigation into whether the company built a tool that helped avoid law enforcement.

In a statement, Lyft said that the number of shares to be offered and the price range for its proposed offering have not yet been determined. Lyft’s valuation based on its last round of funding is estimated at $15 billion. Back in May, Lyft CFO Brian Roberts said that the company has 35% of the ride-sharing market in the U.S.

Lyft reported for its third quarter that it generated $563 million in revenue, up 88% year-over-year. However, the company saw a net loss of $254 million for the quarter — which is up from $195 million in the same quarter one year prior.

In 2016, General Motors invested $500 million in Lyft. And Alphabet led a $1 billion round in Lyft in late 2017. Lyft also has partnerships with Ford and Tata Motors’ Jaguar Land Rover.

Lyft was founded by CEO Logan Green and President John Zimmer in 2012. And Lyft was originally a service under Zimride, which is a long-distance ride-sharing company that Green and Zimmer launched in 2007. Through Zimride, drivers and passengers connected through Facebook and Zimride became the biggest ridesharing program in the U.S.

Green started to develop the idea about Zimride as he shared rides from the University of California, Santa Barbara to visit his girlfriend in Los Angeles. Before launching Zimride, he was using Craiglist’s ride boards but he wanted to remove the anxiety associated with people not knowing the driver or passengers.

The name of the company switched from Zimride to Lyft in May 2013. And Zimride was sold to the parent company of Enterprise Rent-A-Car in July 2013. Now Lyft is now used by more than 1 million rides per day and the company operates in about 300 U.S. cities.