- Walmart is expanding its sponsored product campaign platform. These are the details about the new technology.

Alexis (Lex) Josephs, Vice President Sales & Media Partnerships of Walmart Media Group at Walmart eCommerce, announced that the retail giant is investing in building a more robust in-house advertising offering through its media division. And last year, the company grew its technology offering through the acquisition of Polymorph by strengthening its supply-side ad stack to deliver full native ad campaigns and reports to brands.

The company also brought on new talent across executive and engineering levels and achieved success with campaigns for brand partners like Kellogg’s and Hershey’s. And Walmart offers the ability to maximize campaigns with rich data insights based on in-store and online data at scale.

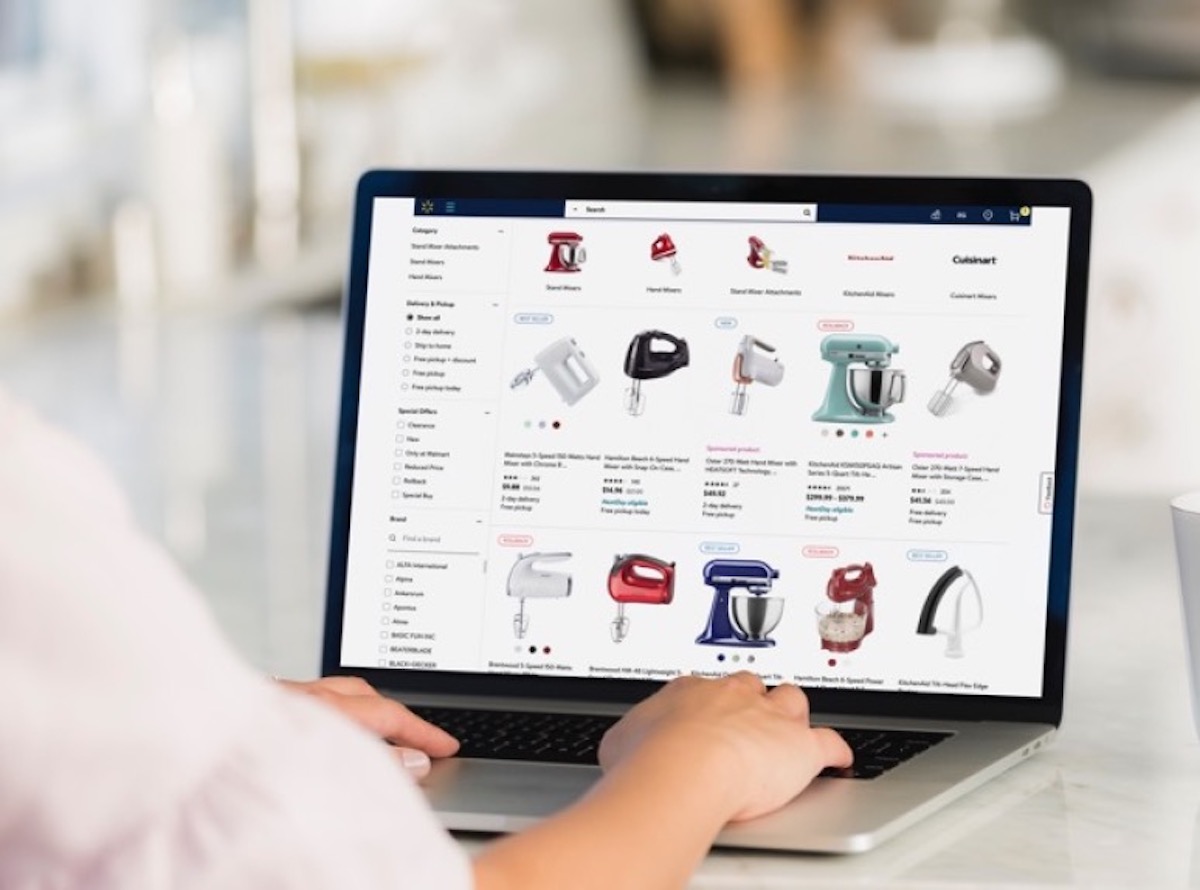

“We’re kicking off 2020 with the launch of our Walmart Advertising Partners program to expand advertisers’ direct access to their Sponsored Products campaigns, a bidded auction-based marketplace, giving them more transparency and control. Brands will now be able to increase visibility with Walmart’s diverse, sizable audience of shoppers,” said Josephs. “With 90 percent of America shopping at Walmart every year and nearly 160 million visitors to our stores and website every week, Walmart Media Group enables brands to reach more customers at scale and measure advertising effectiveness across the entire shopping journey. Now, brands can tap into Walmart’s shopper footprint to get the right sponsored ad experience, to the right shopper at the right moment through partners Flywheel Digital, Kenshoo, Pacvue and Teikametrics.”

Nich Weinheimer, general manager of e-commerce at Kenshoo, told AdAge that Walmart’s differentiator over Amazon is its massive data on offline sales. Now Walmart can attribute digital ads to products purchased in store by consumers.

“The total size of Walmart’s offline footprint dwarfs Amazon’s,” explained Weinheimer via AdAge. “You’re going to see Walmart telling the story of how their digital ads influence offline purchasing behavior.”

The first four partners Walmart signed have leading advertising technology platforms with deep search experience, brand-friendly user interfaces, and a proven history of empowering brands through advisory services and account support.

“This is a smart move by Walmart, and it’s a model we’re continuing to see marketplaces follow. Facebook recently launched its ad platform in a similar self-serve manner, and Amazon made $19 billion last year in ad revenue with its focus on long-tail marketing,” stated Christopher Dessi, VP of Americas at Productsup. “As more options for self-serve advertising unfold, large enterprise dollars will become more distributed across marketplaces. Walmart’s rollout is the perfect timing, as there’s an immediate deep need to diversify media buying to add “network neighbor” demographic buyers, as well as increase reach. The next six months will be interesting to watch, but the real showdown will be in Q4 of 2020 as major retailers gear up for the holidays.”

Walmart runs the second most visited retail website in the U.S. behind Amazon.