Digital fitness company Freeletics announced that it has raised $45 million in Series A funding led by FitLab, Causeway Media Partners, and JAZZ Venture Partners. Courtside Ventures, Elysian Park Ventures, ward.ventures, and Tony Robbins also participated in this round.

The San Francisco 49ers, Boston Celtics, Cleveland Cavaliers, and Los Angeles Dodgers sports teams are affiliated with this investor group. Through its platform, Freeletics promotes physical fitness, mental strength, willpower, and self-confidence.

“The funding outcome reflects tremendous global confidence in a product we have always believed represents the cutting edge of self-development for today’s tech-savvy and health-conscious consumers,” said Freeletics chief executive Daniel Sobhani. “Our investor portfolio has a deeply rooted understanding of the fitness industry, as well as high-growth tech companies. This new round will enable us to once again intensify our strategy for global growth. This round of funding will also support our ongoing commitment to continue delivering a best-in-class digital fitness proposition that’s both effective and easy to use in any place and at any time.”

Freeletics had been bootstrapping since launching in 2013. Across its platform, Freeletics has 31 million users across 160 countries. The company’s flagship app is called “Freeletics Fitness Coach.” And it is the number one fitness app in Europe.

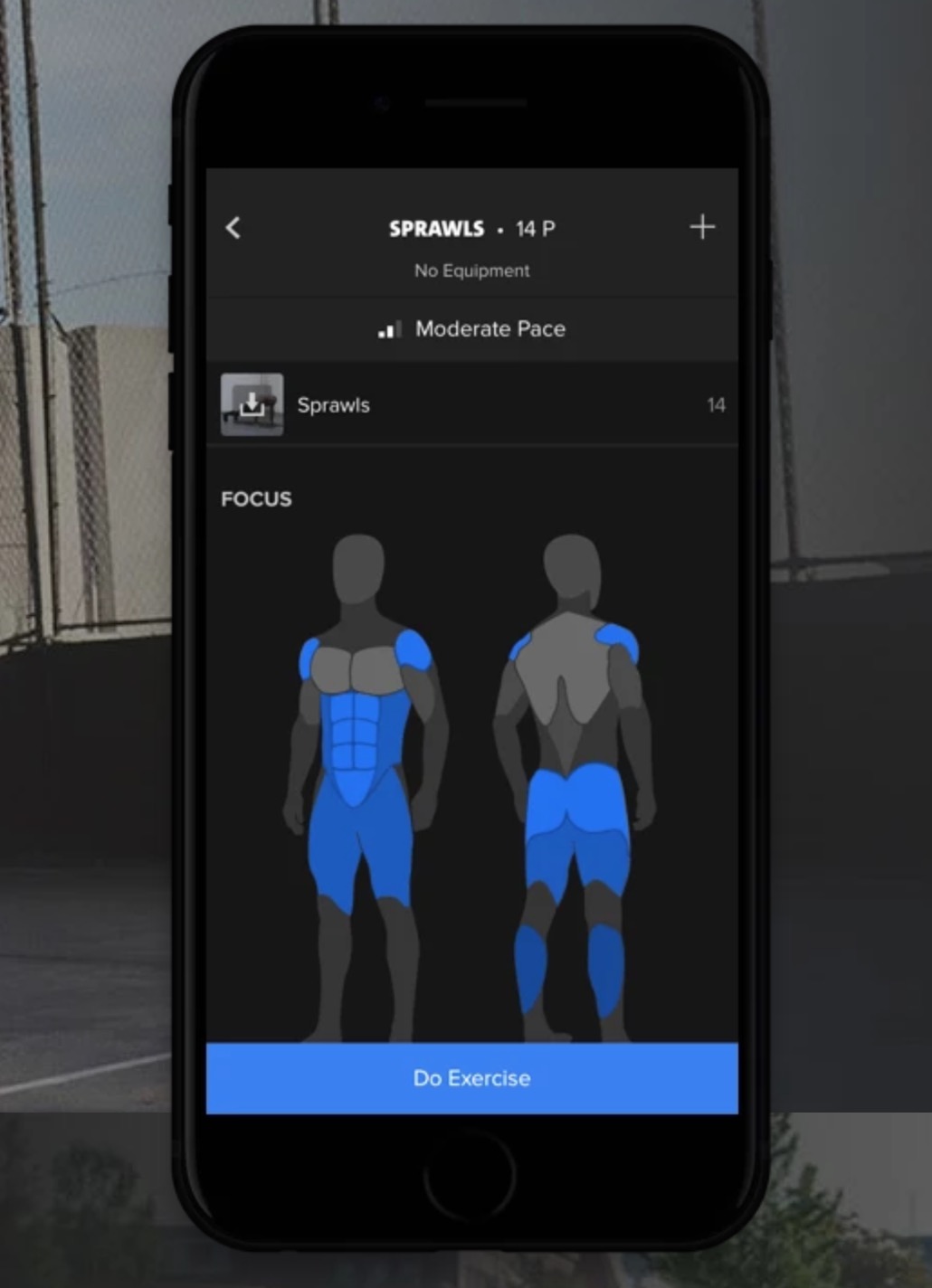

Freeletics has a unique artificial intelligence algorithm that allows the app to learn from workout feedback and create personally tailored workouts. For each user, Freeletics Training Journeys are created. And the company saw 120% growth in core markets over the last six months, including the U.S.

FitLab managing partner Mike Melby said that Freeletics achieved a lot in a short period of time and is looking forward to the partnership. And Causeway Media Partners managing partner Mark Wan pointed out that the oversubscription of this investment round underlines the company’s continued growth.