J.P. Morgan Chase is going to be creating its own cryptocurrency called JPM Coin. This will be the first cryptocurrency created by a major U.S. bank.

And J.P. Morgan is known for moving more than $6 trillion for corporations every day. And only a tiny fraction of that amount will happen through JPM Coin — which will be used to instantly settle payments between clients according to CNBC. Trials for JPM Coin are going to start in the next few months. Like the Bitcoin cryptocurrency, JPM Coin will be relying on a blockchain system.

“The JPM Coin isn’t money per se. It is a digital coin representing United States Dollars held in designated accounts at JPMorgan Chase N.A. In short, a JPM Coin always has a value equivalent to one U.S. dollar. When one client sends money to another over the blockchain, JPM Coins are transferred and instantaneously redeemed for the equivalent amount of U.S. dollars, reducing the typical settlement time,” said the company in a news announcement. “Over time, JPM Coin will be extended to other major currencies. The product and technology capabilities are currency agnostic.”

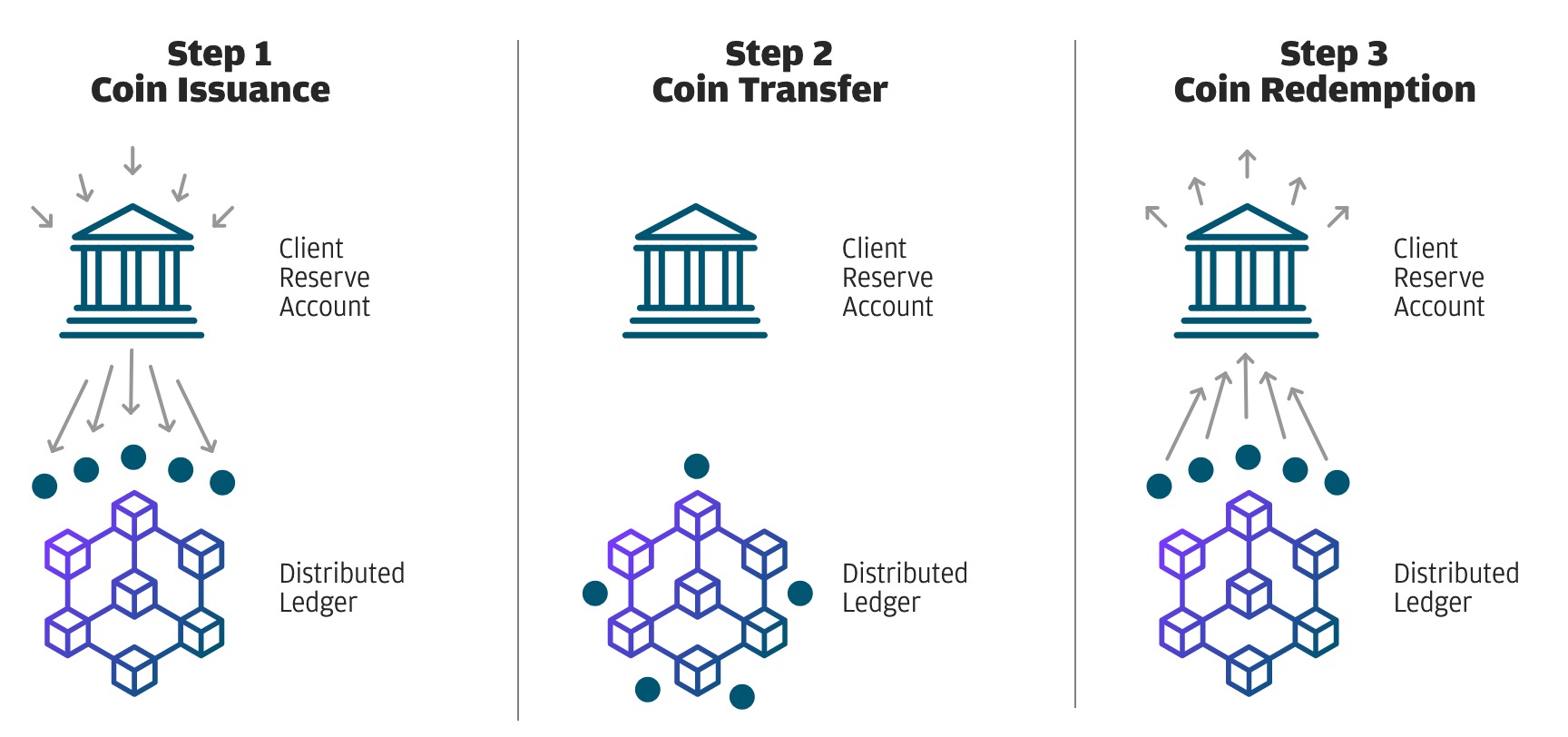

Here is a chart of how it works:

J.P. Morgan’s development of a cryptocurrency comes as a surprise since the technology emerged from the financial crisis and was shunned by major U.S. banks. For example, J.P. Morgan and several other lenders banned the purchase of Bitcoins by credit card customers last year. And J.P. Morgan chairman and CEO Jamie Dimon said that people who buy Bitcoin are “stupid.”

Retail investors are unlikely going to be able to get JPM Coins. Because only larger institutional J.P. Morgan clients that have undergone regulatory checks such as corporations, banks, and broker-dealers are able to use the tokens.

The value of each JPM Coin is set for a single U.S. dollar so the value should not fluctuate. And clients will be issued JPM Coins after depositing dollars at the bank. Once clients use tokens for a payment or security purchase on the blockchain, the bank will eliminate the coins and give clients back the matching number of dollars.

There are going to be three early applications for the JPM Coin including international payments for large corporations (as an alternative to Swift wire transfers), securities transactions, and treasury services businesses (replace the dollars they hold in subsidiaries around the world).

“Money sloshes back and forth all over the world in a large enterprise,” said J.P. Morgan’s head of blockchain projects Umar Farooq via CNBC. “Is there a way to ensure that a subsidiary can represent cash on the balance sheet without having to actually wire it to the unit? That way, they can consolidate their money and probably get better rates for it.”